The federal contracting landscape involves over $755 billion in annual spending and relies heavily on prime-subcontractor partnerships to deliver complex projects. Yet many of these relationships fail due to poorly structured revenue share agreements that create conflict rather than collaboration. Understanding how to build equitable, sustainable partnerships requires moving beyond standard templates to models that align incentives and distribute value fairly.

The Current State of Prime-Sub Relationships

Federal prime contractors work directly with government agencies and bear ultimate responsibility for contract performance. They manage subcontractors who provide specialized capabilities the prime may not possess in-house. This relationship forms the backbone of federal service delivery across defense, civilian agencies, and intelligence community programs.

The numbers reveal how integral these partnerships are: In 2022, approximately $9.9 billion was spent on prime contracting for Native-entity enterprises in Professional and Business Services alone, with $707.8 million flowing to small business subcontractors. Overall federal subcontracting involves over 320,000 unique business-to-business contracts valued at more than $1.5 trillion, with participation from over 900 publicly-listed government subcontractors cumulatively awarded over $430 billion.

Why Traditional Revenue Share Models Fail?

Most prime-sub staffing agreements use simple pass-through models where the subcontractor receives a percentage of the labor rate billed to the government, with the prime retaining the difference. While administratively simple, this approach creates multiple problems.

Misaligned Risk and Reward

Prime contractors face substantial performance risk, compliance burden, and financial exposure. They maintain approved purchasing systems, ensure FAR compliance, manage government relationships, and bear liability for subcontractor performance. Yet in basic pass-through models, primes often retain minimal margin that doesn’t reflect this responsibility differential.

Conversely, subcontractors performing the actual technical work may receive compensation that doesn’t adequately reflect their specialized expertise or the direct value they create for the end client. According to research submitted to the Air Force Institute of Technology, subcontractors don’t typically earn higher median profits compared to prime contractors, though those demonstrating exceptional expertise can secure premium compensation.

Unclear Value Attribution

Traditional models fail to quantify what each party actually contributes to contract success. Does the prime provide merely administrative oversight, or do they deliver substantial project management, quality assurance, and technical direction? Does the subcontractor simply staff positions, or do they bring specialized capabilities that differentiate the solution?

Without clear value attribution, negotiations become adversarial rather than collaborative, with each party seeking to maximize their share without regard to sustainability or fairness.

Compliance Burden Allocation

Federal contracts carry extensive compliance requirements that flow down to subcontractors through FAR clauses. Prime contractors must ensure subcontractors meet these obligations, creating administrative overhead that traditional models don’t adequately compensate.

The 2024 National Defense Authorization Act Section 862 now requires prime contractors to notify contracting officers within 30 days when subcontractor payments are past due, down from the previous 90-day requirement. This heightened scrutiny on payment practices reflects government concern about fair treatment of small business subcontractors, adding another compliance dimension primes must manage.

Revenue Share Models That Create Sustainable Partnerships

Successful prime-sub staffing partnerships structure revenue share to reflect actual value contribution, risk allocation, and long-term relationship sustainability. Several models have emerged as particularly effective:

Revenue Share Models That Create Sustainable Partnerships

This approach allocates revenue based on documented value contribution rather than arbitrary percentages. The prime and sub jointly identify what each party contributes to contract execution and assign economic value accordingly.

For a cybersecurity staffing contract, allocation might consider:

Prime Contributions:

- Government relationship management and contract administration (15% of contract value)

- Quality assurance and technical oversight (10%)

- Compliance infrastructure and audit support (8%)

- Business development and proposal costs (7%)

- Financial risk and working capital (5%)

Sub Contributions:

- Direct technical labor delivery (45%)

- Specialized expertise and certifications (7%)

- Recruitment and talent pipeline management (3%)

Total allocation: Prime 45%, Sub 55%

This model explicitly recognizes that the subcontractor delivering specialized cleared cybersecurity talent creates more direct value than administrative overhead, justifying a larger revenue share. However, it also acknowledges the prime’s substantial infrastructure and risk burden.

Tiered Performance Model

This structure adjusts revenue share based on measurable performance outcomes. Base allocation provides stability, while performance tiers create upside opportunity for both parties.

A typical tiered structure for IT staffing might include:

Base Allocation: Prime 35%, Sub 60%, Performance Pool 5%

Performance Metrics:

- Government customer satisfaction scores

- Staff retention rates

- Time-to-fill for new positions

- Compliance audit results

- Invoice accuracy and timeliness

When performance targets are met, the 5% performance pool splits according to who drove the results. Strong subcontractor recruitment and retention might allocate more performance revenue to the sub. Excellent prime contract management might increase the prime’s share.

This model aligns both parties toward outcomes rather than simply transactional fulfillment.

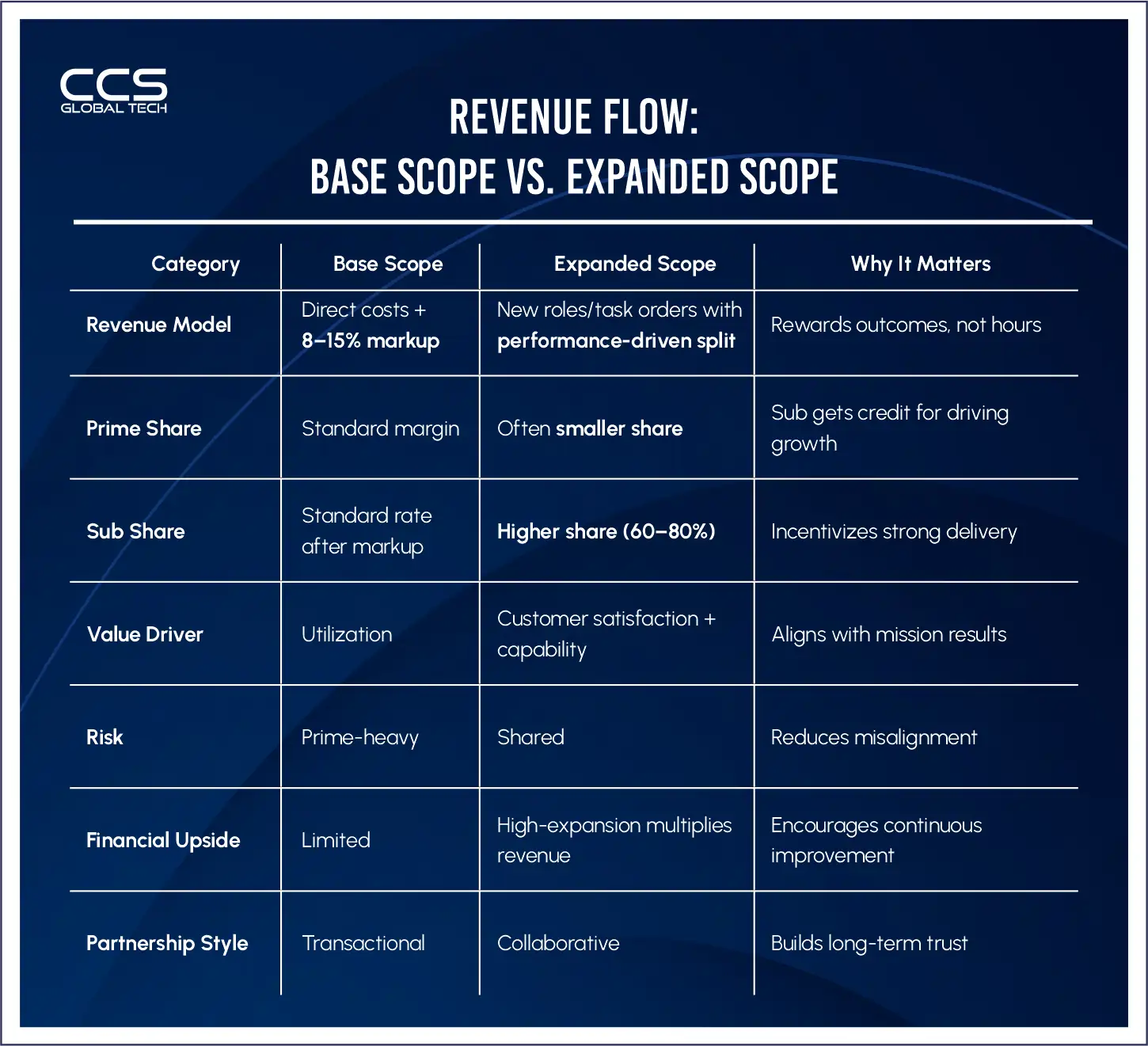

Hybrid Cost-Plus-Incentive Model

Particularly effective for complex, multi-year staffing contracts, this approach combines guaranteed base compensation with shared upside from efficiency gains or expanded scope.

Structure example:

- Phase 1: Base compensation covers all direct costs plus negotiated markup (typically 8-15% for small business subcontractors, per Deltek Clarity Government Contracting Industry Report).

- Phase 2: Scope expansion sharing – when contract scope increases beyond the original statement of work, revenue from new positions or task orders splits differently than base work, often more favorably to the party who enabled the expansion.

- Phase 3: Efficiency incentives – if the team delivers contract requirements with fewer full-time equivalents than budgeted, savings split between prime and sub according to pre-negotiated percentages.

This model particularly suits situations where initial contract scope may expand based on customer satisfaction and where operational efficiencies can create genuine cost savings for the government.

Real-World Application: Defense Logistics Support

Consider a Defense logistics contract requiring supply chain management support across multiple military installations. A large prime contractor partners with a small business subcontractor specializing in military logistics operations.

Traditional approach: The prime bears all financial and performance risk while the sub’s revenue remains static whether they deliver exceptional or merely adequate performance.

Improved value-based approach:

The parties document that the prime provides:

- $2.3M in contract administration, compliance, and government interface (15% of contract value)

- $1.8M in project management, quality assurance, and oversight (12%)

- $850K in business systems, facilities, and infrastructure (5.5%)

The sub provides:

Revenue allocation: Prime 32.5%, Sub 67%, with 0.5% held in performance pool.

Performance metrics include:

- On-time delivery rates

- Inventory accuracy

- Government customer satisfaction

- Staff retention above 85%

When these metrics exceed baseline targets, the performance pool distributes proportionally based on which party’s efforts drove the improvement. This structure creates shared incentive for excellence while fairly compensating actual value contribution.

Six months into performance, the government requests expansion to additional installations. This rewards the sub’s direct delivery excellence while acknowledging the prime’s role in customer relationship management that enabled expansion.

Real-World Application: Civilian Agency IT Support

A civilian agency cybersecurity contract presents different dynamics. A mid-sized prime lacks sufficient cleared cybersecurity professionals to staff the requirement fully. They partner with a specialized sub that maintains a pipeline of cleared security professionals.

Challenge: The sub’s specialized talent is the primary value driver, but the prime manages complex government compliance requirements and maintains the direct customer relationship.

Revenue share structure:

Base allocation:

- Prime: 28% (government relations, compliance, contract admin, financial management).

- Sub: 67% (technical labor, specialized expertise, recruitment).

- Joint reinvestment: 5% (training, certification, capability development).

Workshare guarantees: The agreement specifies the sub will perform minimum 65% of total labor hours, protecting against prime contractor “self-performance” that would undermine the partnership value proposition.

Escalation provisions: Annual rate increases tied to ClearanceJobs compensation data and Bureau of Labor Statistics Employment Cost Index, ensuring both parties maintain margin as market compensation increases.

Payment terms: Prime pays sub within 15 days of government payment receipt (well ahead of the 30-day requirement), creating working capital advantage for the small business sub.

Scope change protocol: If the government adds new technical requirements beyond original scope, the prime and sub jointly assess whether existing capabilities support the work or if new skills are needed. Revenue allocation for new scope reflects this assessment, potentially shifting more to the sub if their expertise enables the expansion.

This structure recognizes the sub as the primary technical value driver while fairly compensating the prime’s relationship management and compliance infrastructure. The joint reinvestment fund builds shared capabilities that benefit both parties long-term.

Key Elements of Effective Revenue Share Agreements

Based on analysis of successful federal staffing partnerships, several elements consistently appear in relationships that create sustainable value:

- Transparent Cost Breakdown– Both parties document their actual costs and overhead structures. This prevents assumptions and creates data-driven allocation discussions rather than positional negotiations.

- Clear Risk Allocation– Agreements specify who bears which risks–financial, performance, compliance, reputational. Revenue allocation should reflect this risk distribution, with higher-risk parties receiving appropriate compensation.

- Defined Value Contributions– Written documentation of what each party actually delivers to contract success. This includes both quantifiable elements (direct labor hours, contract administration) and less tangible but valuable contributions (specialized expertise, government relationships, past performance).

- Performance Accountability– Measurable metrics tied to contract success, with consequences for both exceptional performance and underperformance. This might include retention bonuses for exceeding targets or allocation adjustments if performance falls below baseline.

- Payment Terms– Specific timelines for payment flow-through from prime to sub. The NDAA 2024 changes emphasize prompt payment, with late payments now reported within 30 days and affecting prime contractor past performance ratings. Clear payment terms prevent disputes and demonstrate good faith.

- Scope Change Protocols– Pre-negotiated approaches for how revenue allocates if contract scope expands, contracts, or shifts in nature. This prevents renegotiation during performance that can damage relationships.

- Dispute Resolution– Specified mechanisms for resolving allocation disagreements without litigation–typically mediation or binding arbitration with industry-experienced neutrals.

- Compliance Burden Sharing– Clear allocation of who manages which compliance requirements and how the associated costs are compensated. This might include prime responsibility for audit support with compensation through administrative fees, or shared compliance costs during proposal development.

The Path Forward

Prime-sub staffing partnerships grow critical amid agency workforce gaps and budgets. Success demands equitable revenue shares based on value, aligned incentives, fair risk.

Pass-through models fail-unsustainable vs. value-based sharing that endures challenges. Evolve now: Contractors mastering performance-oriented partnerships outperform transactional competitors.

CCS Global Tech structures prime-subcontractor partnerships that create genuine value for all parties, prime contractors, subcontractors, and government customers. Our two decades of federal contracting experience enables us to develop revenue share models that align incentives, distribute risk fairly, and build sustainable competitive advantage.

Are you ready to strengthen your federal contractor relationships with equitable, performance-driven partnership structures?

FAQs

Q 1. How do prime–sub revenue share models impact contract delivery speed?

A: Revenue share structures influence how quickly teams mobilize. When the subcontractor receives a higher share tied to delivery outcomes, they allocate stronger talent faster. When the prime retains more for PMO/oversight, delivery can slow unless accountability is built into the model.

Q 2. What’s the most common mistake companies make when structuring prime–sub revenue splits?

A: The biggest mistake is aligning compensation with hours billed instead of value delivered. This creates pass-through arrangements rather than performance-driven partnerships. High-performing subs end up carrying the load without being rewarded.

Q 3. How do you prevent a prime contractor from over-self-performing and starving the sub of meaningful scope?

A: Include contractual protections: minimum labor-hour allocations, jointly approved staffing plans, and transparent productivity metrics. Governance bodies with equal representation also prevent scope erosion.

Q4. Which revenue share model works best for high-skill, cleared-talent delivery?

A: For cybersecurity, cloud, and data-engineering work, outcome-based or capability-based models outperform flat splits. These models reward subs who bring niche talent, pre-cleared pipelines, or specialized expertise the prime cannot replicate.

Q5. How should small subs negotiate revenue share with large primes?

A: Small subs should anchor negotiations on unique value — pre-cleared candidates, past performance, niche certifications, or rapid staffing velocity. Primes will pay more when the sub owns the delivery risk they can’t cover..

Q6. When should revenue share be tied to performance metrics?

A: Performance-linked splits are ideal when contracts involve SLAs, cybersecurity readiness, zero-trust milestones, or cloud migration timelines. Milestone-based bonuses keep both parties aligned on delivery quality and speed.

Q7. How do primes justify their share of the revenue in staffing partnerships?

A: Primes typically retain a portion for customer relationship management, PMO oversight, billing/compliance infrastructure, and risk management. Clear documentation of these functions prevents disputes and creates transparency.

Q8. What governance structure ensures fair revenue distribution between prime and sub?

A: A joint governance committee with shared authority over staffing decisions, risk escalations, and performance reviews ensures that no party dominates scope allocation or financial control.

Q9. How do revenue share models differ between commercial and federal staffing contracts?

A: Federal contracts often impose FAR-based restrictions (e.g., limitations on subcontracting), while commercial partnerships allow more flexible gain-sharing and milestone-driven bonuses. Primes in federal environments must balance compliance with partner incentives.

Q10. Can subcontractors negotiate gain-share or re-investment clauses in staffing partnerships?

A: Yes. High-performing subs often negotiate gain-share on expanded scope or reinvestment funds (e.g., training budgets, capability development) that strengthen long-term partnership value.