Treasury announced a $9 billion audit November 6, 2025. The audit will examine potential misuse of the Small Business Administration’s 8(a) Business Development Program, and other initiatives that provide federal contracting preferences to certain eligible businesses.

These actions follow Treasury’s earlier suspension and termination of all contracts and task orders with ATI Government Solutions, following allegations of fraud involving more than $253 million in previously issued contract awards.

Most 8(a) firms see this as a threat. They’re wrong.

Here’s what most people are missing: To create greater accountability, Treasury’s acquisition professionals have been instructed to require detailed staffing plans and monthly workforce performance reports for all service contracts U.S. Department of the Treasury. These aren’t compliance burdens. They’re competitive advantages for legitimate firms.

The November 6 announcement changes the federal contracting landscape. Firms that understand the new staffing requirements will win contracts fraudulent pass-through schemes cannot execute.

What the November 6 Treasury Audit Actually Means?

Treasury Secretary Scott Bessent stated: “President Trump has directed his administration to eliminate fraud and waste wherever it occurs, ensuring that each taxpayer dollar is spent as intended. Treasury will not tolerate fraudulent misuse of federal contracting programs. These initiatives must benefit legitimate small businesses that deliver measurable value to the government and the public.”

SBA Administrator Kelly Loeffler added: “During the Biden Administration, federal contracting set-aside programs proliferated without scrutiny or oversight – which is why the SBA launched a full audit of the 8(a) Business Development Program earlier this year to examine contracts across every agency. This Administration will not tolerate DEI-based contracting and abuse that compromises opportunity for legitimate and eligible small businesses.”

The audit addresses a specific problem: pass-through arrangements. Some contractors appear to have used schemes to subcontract work they were supposed to do themselves under the Section 8(a) Business Development Program. Some of its whistleblower employees said ATI did only about 20% of the government work while subcontracting the rest of it to bigger companies.

These aren’t just statistics. The audit is expected to focus on small business and Section 8(a) program misclassifications. However, this audit may also examine other classifications such as women-owned small businesses (WOSB), service-disabled veteran-owned small business (SDVOSB), and HUBZone businesses.

But legitimate 8(a) firms performing their own work have nothing to fear. The new requirements create differentiation.

The New Staffing Requirements: Your Competitive Advantage

Treasury’s acquisition professionals have been instructed to require detailed staffing plans and monthly workforce performance reports for all service contracts. These tools will help detect non-performance and pass-through contracting that could point to potential fraud.

Most firms see documentation requirements as administrative burden. Smart firms see market opportunity.

Detailed staffing plans demonstrate:

- Real workforce capacity to execute contracts.

- Specific personnel with required clearances and expertise.

- Organizational capability beyond paper credentials.

- Commitment to performing work in-house.

Monthly workforce performance reports prove:

- Actual contract performance by firm employees.

- Real value delivery to government customers.

- Legitimate business operations vs. pass-through schemes.

- Measurable outcomes tied to specific staff.

Fraudulent pass-through arrangements cannot produce these reports without exposing the scheme. Legitimate firms performing real work produce them naturally.

The competitive advantage is simple: firms that can demonstrate actual workforce performance win. Firms that cannot, don’t.

How Small Businesses Navigate the Current Environment?

The audit announcement came during the 43-day shutdown, creating additional pressure on small contractors. Small business owners with government contracts say the shutdown has caused payment delays and the cancellation of some projects, and they will be working to make up for lost time and money, if the government reopens.

Jackson Dalton, owner of Black Box Safety, a maker of personal protective equipment, was awarded a $1.9 million federal contract for flashlights the day before the shutdown started on Oct. 1. The contract, which would account for 6% of his annual revenue, required the company in El Cajon, California, to spend $1 million at the outset. Dalton said he was unable to because the contracting office did not return his emails or phone calls.

Eric Veal, owner of Interactive Knowledge in Charlotte, North Carolina, explained his situation: “Federal employees are not able to work at all, and invoices and projects are at a complete halt. Our cash flow is affected, and so we are having to make small-level changes in terms of expenditures.”

What Legitimate 8(a) Firms Must Do Now?

The November 6 announcement creates immediate action items for firms pursuing or holding 8(a) contracts.

1. Document your actual workforce capacity before the next proposal

Small and disadvantaged businesses who hold current or recent contracts with Treasury should prepare for the upcoming audit and ensure they can provide proper documentation to support prior certifications of their small or disadvantaged status Morgan Lewis.

Build detailed staffing plans that show:

- Named personnel with specific qualifications.

- Security clearance levels and adjudication dates.

- Prior performance on similar work.

- Organizational chart showing reporting relationships.

- Subcontractor relationships (if any) with clear work allocation.

Firms that can demonstrate this level of detail before proposal submission differentiate immediately.

2. Implement monthly workforce performance tracking systems

Treasury has instructed acquisition professionals to require monthly workforce performance reports for all service contracts. Don’t wait for contract award to build these systems.

Track monthly:

- Staff assigned to each contract.

- Hours worked by contract and task.

- Deliverables completed by staff member.

- Subcontractor work percentage (if applicable).

- Performance metrics tied to specific personnel.

Firms that already have these systems demonstrate operational maturity. Those building them after contract award look reactive.

3. Differentiate your proposals with verifiable staffing commitments

Generic staffing sections won’t win in the post-audit environment. Agencies need proof of real capacity.

Include in proposals:

- Resumes showing relevant experience on similar contracts.

- Letters of commitment from named personnel.

- Clearance verification documentation.

- Organizational capability statements backed by current staff.

- Past performance examples with same personnel.

Although this audit currently remains limited to the Department of Treasury, it is part of a larger trend across the federal government to crack down on government contracting fraud. Agencies beyond Treasury will adopt similar scrutiny.

4. Audit your own subcontractor relationships now

Prior use of contracting preferences that fall outside normal procurement rules may have enabled large companies to use pass-through arrangements where an eligible small business retains fees for minimal participation while subcontracting nearly all the actual work.

Prior use of contracting preferences that fall outside normal procurement rules may have enabled large companies to use pass-through arrangements where an eligible small business retains fees for minimal participation while subcontracting nearly all the actual work.

Audit questions:

- What percentage of work do we perform in-house?

- Can we demonstrate value-add beyond subcontractor management?

- Do we have staff performing technical oversight?

- Are our management fees justified by actual services?

- Could we defend our subcontractor structure to investigators?

Businesses with potentially inaccurate small or disadvantaged business representations may consider a proactive approach to disclosure in light of the forthcoming audits.

This does not constitute legal advice. Small businesses should consult qualified legal counsel regarding 8(a) program compliance, subcontractor relationships, and audit preparation.

5. Position staffing capability as your primary competitive advantage

Last year, there were at least 65,500 small business contractors located in all 50 states who received over $155 billion in payment for goods and services provided to the federal government. The $155 billion market remains. The differentiation mechanism changed.

Agencies need confidence that 8(a) awards go to firms performing real work. Demonstrate that confidence through:

- Detailed staffing plans showing actual capacity.

- Monthly reporting systems already in place.

- Past performance showing staff continuity.

- Cleared talent pipelines for future growth.

- Transparent subcontractor relationships.

The Opportunity in Increased Scrutiny

The federal government offers several programs that provide small and disadvantaged businesses preferences in obtaining federal contracts, including contracts set aside for such businesses or evaluation preferences for these entities Morgan Lewis. These programs remain valuable.

The 8(a) program, which is designed for socially and economically disadvantaged businesses, is already under audit by the SBA which is examining contracts across every agency. But increased scrutiny benefits legitimate firms.

Market dynamics favor firms that can demonstrate:

- Real workforce capacity to execute contracts.

- Transparent operations agencies can verify.

- Actual performance capability vs. paper credentials.

- Legitimate business models vs. pass-through schemes.

The firms eliminated by increased scrutiny are the ones using fraudulent pass-through arrangements. The firms winning are the ones performing real work with real staff.

The Post-Audit Competitive Landscape

Treasury’s November 6 announcement signals government-wide change. Although this audit currently remains limited to the Department of Treasury, this action could encourage other agencies to conduct similar audits, especially in light of the US administration’s priorities of cost-cutting and terminating contracts that appear connected to diversity, equity, and inclusion (DEI).

Agencies across government will adopt detailed staffing plans and monthly workforce reporting. The firms prepared for these requirements win. Those treating them as administrative burdens lose.

The $155 billion small business contracting market remains. The competitive advantage shifted to firms demonstrating actual workforce capability.

8(a) firms with real operations, real staff, and real performance capability have the strongest position they’ve had in years. Fraudulent schemes face elimination. Legitimate firms face opportunity.

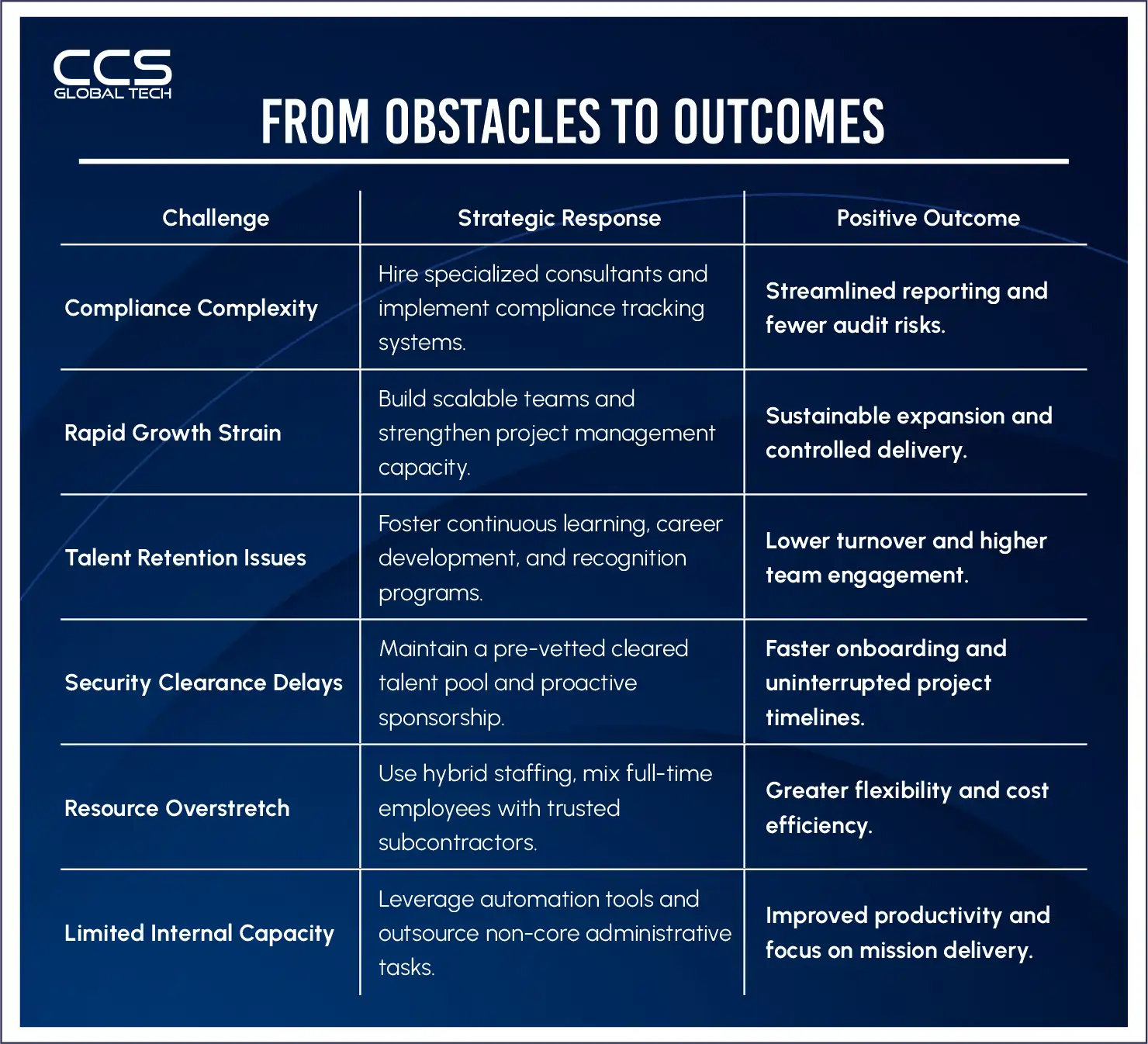

This audit isn’t a disruption for legitimate 8(a) firms, it’s a competitive reset. Those with real teams and proven performance now have the upper hand. CCS Global Tech partners with federal contractors to build resilient, audit-ready, delivery-focused talent pipelines.

FAQ

Q1. How has the post-audit environment changed the way 8(a) firms compete for contracts?

A: Agencies are now scrutinizing real staffing capability, operational capacity, and workforce documentation. This shift rewards firms with verified teams and exposes paper-based entities that relied on borrowed resumes or pass-through models.

Q2. Why do legitimate 8(a) firms benefit from the new staffing requirements?

A: Legitimate firms gain a clear advantage because agencies prioritize companies that can prove they have actual employees, compliant payrolls, and a track record of delivery. Fraudulent structures are being filtered out, leveling the playing field.

Q3. What staffing documentation are agencies asking 8(a) firms to provide?

A: Agencies may request detailed staffing plans, organizational charts, payroll records, timesheets, subcontractor agreements, resumes of key personnel, and proof that past performance was executed by the firm’s own employees.

Q4. How do monthly workforce reporting requirements impact 8(a) firms?

A: Monthly reporting eliminates inflated or fake staffing claims. Firms with clean HR systems, clear payroll data, and documented employee roles gain greater trust and credibility during proposal evaluations.

Q5. Can subcontract-heavy 8(a) firms remain competitive under these new rules?

A: Yes, but only if they maintain transparency, control over key positions, and ensure all subcontractors meet compliance requirements. Pass-through firms face far more scrutiny and risk losing competitiveness.

Q6. What types of 8(a) firms are best positioned to succeed after the audit?

A: Firms with in-house W-2 teams, verifiable delivery capability, stable cleared personnel, and compliance-first HR structures are best positioned to win. Their operational strength aligns directly with agency expectations.

Q7. How do the new staffing requirements affect pricing for 8(a) bids?

A: Legitimate firms with real employees can price more accurately based on actual labor costs. Firms that previously underbid using unrealistic or borrowed labor structures can no longer sustain artificially low rates.

Q8. How does past performance factor into awards in the post-audit environment?

A: Past performance tied to genuine employees carries more weight than ever. Agencies prioritize firms that have delivered work using their own teams rather than relying on subcontractor resumes.

Q9. How can 8(a) firms demonstrate workforce readiness in proposals?

A: Firms can showcase employee rosters, cleared talent, training investments, delivery case studies, real résumés, and detailed workforce plans that prove they can begin execution immediately.

Q10. What steps should legitimate 8(a) firms take to stay ahead in this new landscape?

A: Strengthen HR compliance, enhance workforce documentation, invest in employee development, maintain clean data, and build a reliable mix of internal staff and compliant subcontractors to demonstrate execution readiness.