As a federal contractor, you’ve just won a coveted position on a $50 Billion, 10-year Indefinite Delivery/Indefinite Quantity (IDIQ) vehicle for next-generation defense IT services. The first Task Order (TO) solicitation is imminent, requiring a rapid surge of highly specialized talent, including a mandatory Key Personnel slate of a Program Manager, Chief Architect, and five Principal Engineers, all requiring a Top Secret/Sensitive Compartmented Information (TS/SCI) clearance.

Your firm, the Prime Contractor (and Prime, henceforth), has the management structure and past performance, but your small business partner, the one essential for meeting the Small Disadvantaged Business (SDB) subcontracting goal, holds the bulk of the available, ready-to-deploy TS/SCI-cleared engineers.

How do you structure your Teaming Agreement to secure that talent immediately, protect the clearance processing investment, and ensure the cost-plus-fixed-fee (CPFF) Task Order properly allocates burdens and profits?

This is the core strategic challenge: winning the work requires a pre-baked staffing plan that simultaneously satisfies federal regulations and maximizes contractor benefit.

The Federal Contractor Context

The federal marketplace transforms every staffing decision into a contractual and compliance risk. A Teaming Agreement is more than a handshake; it is the binding document that preemptively solves these mission-critical staffing problems.

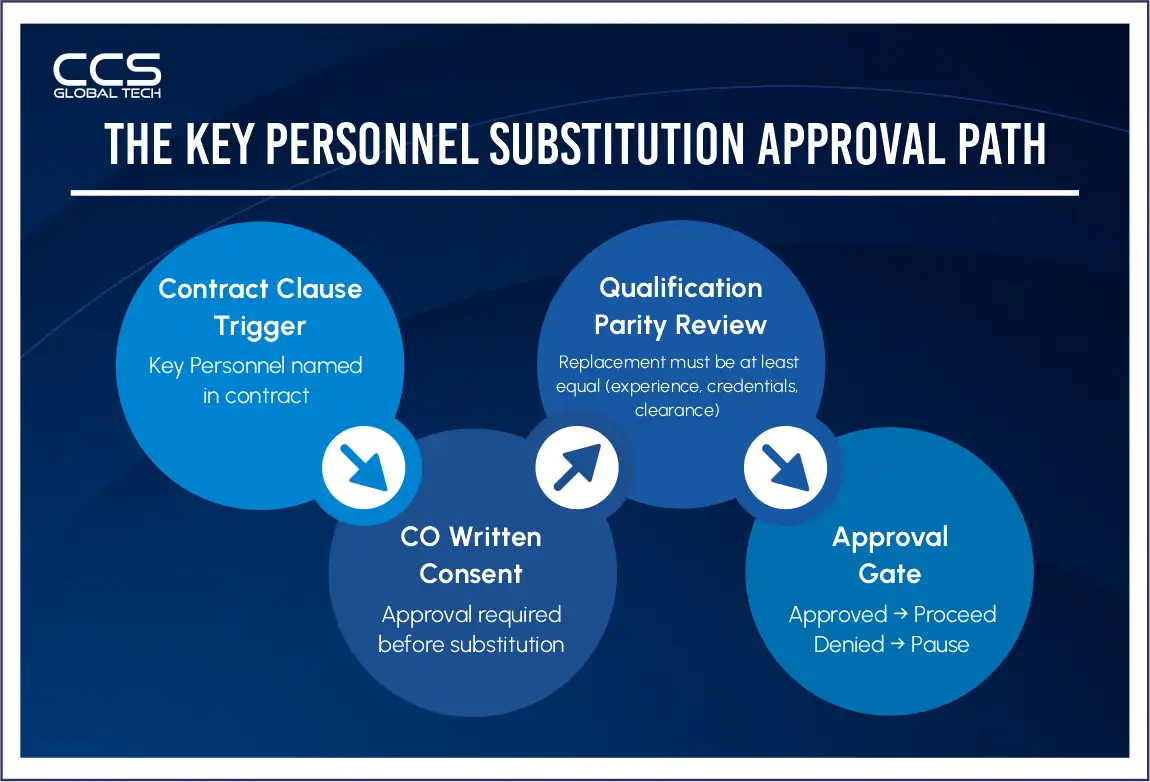

Key Personnel Requirements: Federal Acquisition Regulation (FAR) clauses (like the Department of Commerce’s version, 48 CFR Section 1352.237-75) explicitly dictate that the contractor must obtain the Contracting Officer’s (CO) written consent prior to making Key Personnel substitutions.

The replacement must be of at least equal qualifications. If the small business partner holds the Key Personnel, their unexpected turnover puts the entire contract, and the Prime’s reputation, at risk. The Teaming Agreement must detail commitment, exclusivity, and replacement protocols.

Security Clearance as a Scarce Resource: Talent acquisition in the national security space is dominated by the clearance status, not just the skill set. A Teaming Agreement must define the talent pool contribution, cost allocation for new clearance sponsorship, and strategies for using clearance reciprocity to expedite personnel transfers.

Cost Structure Alignment: In a cost-reimbursement environment (like CPFF), the Prime is responsible to the government for the subcontractor’s incurred costs. The Teaming Agreement must clearly define how indirect rates, burdens, and profit pools are calculated and paid to ensure compliance, avoid commingling of funds, and prevent the appearance of an improper pass-through, especially concerning small business requirements.

The Cleared Talent and Compliance Imperative

The decision to team hinges on verified realities about clearance timelines and small business mandates.

Strategic teaming is the only viable method to bridge the gap between proposal deadlines and the snail-like pace of the federal security apparatus.

| Metric/Requirement | Verified Data/Goal | Strategic Staffing Implication |

| TS/SCI Clearance Processing Time (Average) | 8 to 15 months for initial Top Secret/SCI, post-eQIP submission | Un-cleared talent cannot meet rapid Task Order demands; necessitates the use of already-cleared partner talent. |

| Clearance Reciprocity | Reciprocity determinations by DCSA average a single day (as of FY2022) | Prioritize partner personnel with current, active clearances to virtually eliminate the time-to-staff delay for many roles. |

| Small Business Prime Contracting Goal | The government-wide goal is 23% of all prime contract dollars. | Primes must demonstrate a plan to meet statutory small business goals, often requiring strong subcontracting agreements with SDBs, WOSBs, or SDVOSBs. |

| Small Disadvantaged Business (SDB) Goal | Government-wide goal is 5% for prime and subcontract awards (FY2025). | Drives the necessity of teaming with certified SDBs and requires cost-sharing arrangements that demonstrate ‘maximum practicable opportunity’ for the partner. |

[WOSBs = Women owned Small Businesses; SDBs = Small Disadvantaged Businesses; SDVOSBs = Service-Disabled Veteran-Owned Small Businesses; DCSA = Defense Counterintelligence and Security Agency]

Federal Contractor-Specific Challenges and Opportunities

The Teaming Agreement offers an opportunity to convert compliance challenges into competitive advantages.

The TS/SCI Talent Pool Constraint

The true value of a cleared staffer is the investment already made by the government and the employer. With average federal time-to-hire exceeding 90 days for many roles, and TS/SCI processing consuming the better part of a year, the cleared talent pool is hyper-competitive.

Challenge: If the Small Business partner provides the Key Personnel, they have extreme leverage. If the contract is terminated, the Prime loses the personnel and the Small Business partner retains them, free to leverage their now-proven performance on the Prime’s prior work.

Opportunity (for the Partner): The Teaming Agreement can lock in a favorable load factor (burdened labor rate) and a protected profit margin, guaranteeing the partner a stable revenue stream in exchange for the use of their most valuable asset: their cleared employees.

Small Business Teaming and the 'Rule of Two'

Teaming is essential for large business primes to access small business set-asides or meet subcontracting plan requirements on full-and-open contracts.

Opportunity: On full-and-open contracts over the $750,000 threshold (for non-construction), a subcontracting plan is required. By structuring the Teaming Agreement for the small business partner to own the cleared talent pool, the Prime instantly satisfies the most risk-prone part of its subcontracting goal: providing high-value labor.

This strategic allocation of high-cost labor improves the Prime’s Small Business Subcontracting Scorecard.

Solution/Implementation Guidance: Structuring the Staffing & Costs

The Teaming Agreement must clearly allocate the responsibility for the staff and the associated costs.

Talent Provision and Key Personnel Management

- Talent Commitment: The Teaming Agreement must include a schedule listing all pre-vetted personnel, their clearance level (TS/SCI, Secret, etc.), and their commitment to the upcoming Task Order. The Small Business partner commits the personnel, but the Prime must define the standards for their performance.

- Replacement Protocol: The Prime must have the right of first refusal on replacement candidates. Furthermore, the Agreement should require the Partner to notify the Prime immediately upon learning of a Key Personnel’s intent to resign. The Prime’s consent for replacement should be a clear, documented process, mirroring the subsequent process required for the CO’s approval.

- Clearance Sponsorship Costs: If new clearances (or upgrades, e.g., Secret to TS/SCI) are required, the Teaming Agreement must allocate the cost of the process (time, administrative fees, background checks). It should also stipulate who retains the benefit of the clearance (i.e., who gets to keep the employee if the contract ends) to protect the investment.

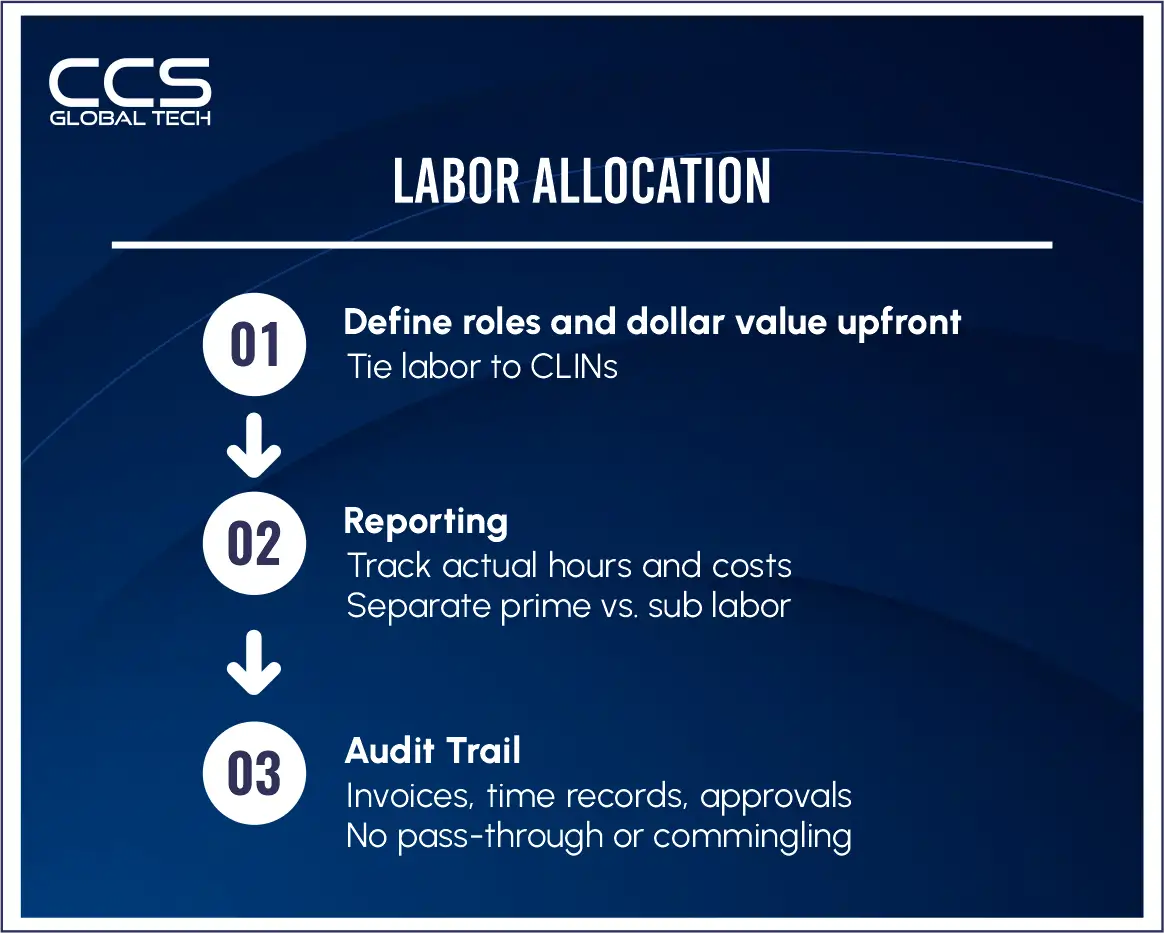

Cost and Pricing Structure

The compensation structure must align with the cost-reimbursable nature of the work.

Cost Element | Small Business Partner Provides | Prime Contractor Responsibility |

Direct Labor & Benefits | Provided by the Partner (employee is on their payroll). | The Prime reimburses the Partner’s fully burdened rate as a subcontract cost. |

Overhead Rate | Applied by the Partner on their direct labor base. | Prime must review/audit Partner’s disclosed indirect rates to ensure compliance/allowability before submission to the CO. |

Key Personnel Retention Bonus | Paid by the Partner. | Cost may be a reimbursable direct charge under the subcontract, provided the CO approves the cost as reasonable and allowable. |

Profit/Fixed Fee | A negotiated percentage/amount applied to the Partner’s total cost base. | Must be clearly separated from the Prime’s profit to prevent entanglement in the Prime’s overall fee pool. |

Real-World Application: Task Order Case Study

Scenario: A $15 Million, 3-year CPFF Task Order requires 12 cleared Subject Matter Experts (SMEs), including two TS/SCI Key Personnel. The Prime, a large business, has the managerial depth. The Small Disadvantaged Business (SDB) Partner has 8 of the 12 required TS/SCI-cleared SMEs, including one Key Personnel.

Staffing Structure: The Teaming Agreement stipulates the SDB Partner will provide 75% of the initial personnel (9/12).

Cost Structure: The SDB Partner’s fully burdened rate is agreed upon, with a guaranteed 8% fixed fee on their incurred costs. The Prime agrees to sponsor the next two clearances for SDB employees as a reimbursable cost under the subcontract, provided the employees remain with the SDB for a minimum of 18 months post-clearance grant.

Outcome: The Prime immediately submits a proposal with all Key Personnel pre-identified and committed, eliminating the 12-18 month personnel acquisition risk. The SDB partner secures a guaranteed flow of work and a protected profit margin, allowing them to confidently invest in their cleared workforce.

The Prime uses the SDB’s provided effort to substantially overachieve the mandated 5% SDB subcontracting goal for the year, mitigating risk on other large contracts.

Strategic Implementation Steps for Maximum Contractor Benefit

- Baseline the Talent: Before signing the Teaming Agreement, the Prime must verify the Partner’s committed personnel, their clearance status (including Periodic Review date), and their exclusive commitment to the Teaming effort upon award.

- Negotiate Exclusivity and Non-Solicit: The Agreement must include a robust non-solicitation/no-poach clause for the duration of the contract plus a reasonable period post-termination (e.g., 12-24 months). This protects the Prime’s investment in its own and its partners’ workforce.

- Audit the Cost Proposal: Primes must demand and review the Partner’s full cost breakdown (direct labor, fringe, G&A, and Overhead) to ensure the proposed subcontract price is compliant, auditable, and reasonable to the government. This is essential for a successful Defense Contract Audit Agency (DCAA) review.

- Align to Small Business Goals: Quantify the dollar value of the Partner’s labor effort and track it against the Prime’s annual subcontracting plan. Use the Teaming Agreement to explicitly state this alignment.

Final Strategic Assessment: Key Takeaways

The federal contracting landscape is fundamentally defined by two critical drivers: speed in securing mission-critical talent and unwavering compliance with complex regulations. This environment establishes time-to-clearance, the long and unpredictable process of obtaining and transferring security clearances, as the single most critical bottleneck in talent acquisition.

Consequently, in a marketplace where statutory small business participation goals are non-negotiable mandates backed by government-wide scorecards, the ability to rapidly staff a contract with pre-vetted, mission-ready, and already-cleared professionals becomes the single greatest competitive advantage any firm can possess.

Any failure to proactively and robustly structure the staffing provisions within a Teaming Agreement translates immediately into tangible, severe consequences, ranging from the immediate loss of a proposal opportunity and exposure to contract breach and termination to the long-term detriment of negative past performance ratings that preclude future lucrative pursuits.

Three Strategic Urgency Questions:

a) Is your current Teaming Agreement language robust enough to legally compel a small business partner to maintain and replace mission-critical Key Personnel, or are you risking a contract breach that results in a cure notice?

b) Have you quantified the exact dollar value and percentage contribution of your Small Business partner’s cleared labor pool to ensure you meet and exceed the government-wide 5% SDB goal and maximize your SBA Scorecard rating?

c) Does your cost-sharing structure explicitly address clearance sponsorship investment and retention bonuses, protecting your firm’s financial commitment from being leveraged by a partner for future, competing bids?

CCS Global Tech specializes in navigating the complex intersection of federal compliance and high-stakes staffing. We provide the expertise to architect Teaming Agreements that are fully compliant with FAR Key Personnel clauses and maximize small business socioeconomic goal attainment. We ensure your cost structures are auditable and your talent pipeline, especially for TS/SCI-cleared roles, is secured and managed for optimal mission success.

FAQs

Q1. Who is responsible for providing talent in a teaming agreement?

A: Talent responsibility depends on how roles are allocated between the Prime and subcontractor. Well-structured teaming agreements clearly define which party provides specific labor categories, key personnel, and surge staffing to avoid post-award risk.

Q2. Why is unclear talent ownership risky in teaming agreements?

A: Unclear ownership creates delivery and compliance risk. Even when a subcontractor provides personnel, the Prime remains accountable to the government for staffing failures, delays, or turnover.

Q3. How should key personnel be handled in a teaming agreement?

A: Key personnel should be explicitly named, exclusive to the contract, and governed by replacement and approval protocols aligned with FAR requirements and Contracting Officer consent.

Q4. What happens if a subcontractor loses key personnel after award?

A: The Prime may face contract delays, compliance exposure, or reputational risk. Teaming agreements should require advance notice, qualified replacements, and Prime approval before substitutions.

Q5. How should staffing costs be structured in cost-reimbursement contracts?

A: Staffing costs must be transparent and auditable. Teaming agreements should define direct labor, indirect rates, burdens, and profit treatment to ensure DCAA compliance.

Q6. Why is cost transparency critical in teaming agreements?

A: Cost transparency protects the Prime during audits. Without clear labor and indirect cost documentation, questioned or disallowed costs can arise.

Q7. How do teaming agreements prevent improper pass-through risk?

A: They document each party’s labor contribution and value-add, ensuring subcontractor participation is substantive and compliant with small business regulations.

Q8. Who pays for clearance sponsorship in a teaming model?

A: Clearance sponsorship responsibility must be explicitly defined in the teaming agreement to avoid disputes over cost, delays, and non-billable bench time.

Q9. How does clearance ownership affect staffing risk?

A: When subcontractors hold cleared personnel, turnover risk increases. Agreements should address clearance reciprocity, redeployment rights, and contingency staffing.

Q10. How should small business labor be tracked for compliance?

A: Small business credit is earned based on actual hours and dollars performed, not planned estimates. Accurate tracking supports subcontracting plan compliance and audits.