Meet Lisa, a dedicated federal recruitment manager facing an urgent challenge: her agency needed to fill several specialized cybersecurity roles crucial to national security. With retirements looming and an increasingly competitive talent market, Lisa knew the old approach- posting jobs on USAJOBS and hoping for the best- would no longer work. Candidates slipped through cracks, processes lagged, and leadership demanded clear proof that recruitment efforts were making an impact.

Lisa’s turning point came when her team adopted a data-driven approach- tracking and acting on key performance indicators (KPIs) like time-to-hire, cost-per-hire, and candidate satisfaction scores. Using these insights, Lisa’s team reduced hiring times by 30%, improved quality-of-hire metrics significantly, and boosted first-year retention by 15%. Their story is just one example of how federal recruitment teams in 2025 are transforming from order-takers to strategic workforce builders.

Data reflects this urgency and transformation: The federal government employs over 3 million people, forming 1.5% of the civilian workforce, and the demand for technical talent, especially in cybersecurity, is higher than ever Bureau of Labor Statistics. Meanwhile, 46% of HR leaders anticipate flat or decreased recruiting budgets in 2025, underscoring the critical need to optimize recruitment strategies for efficiency and impact Gartner via Compono.

So, without any further ado, lets explore the KPI’s your recruitment team needs to prioritize in 2025.

Top KPIs for Federal Recruitment Teams

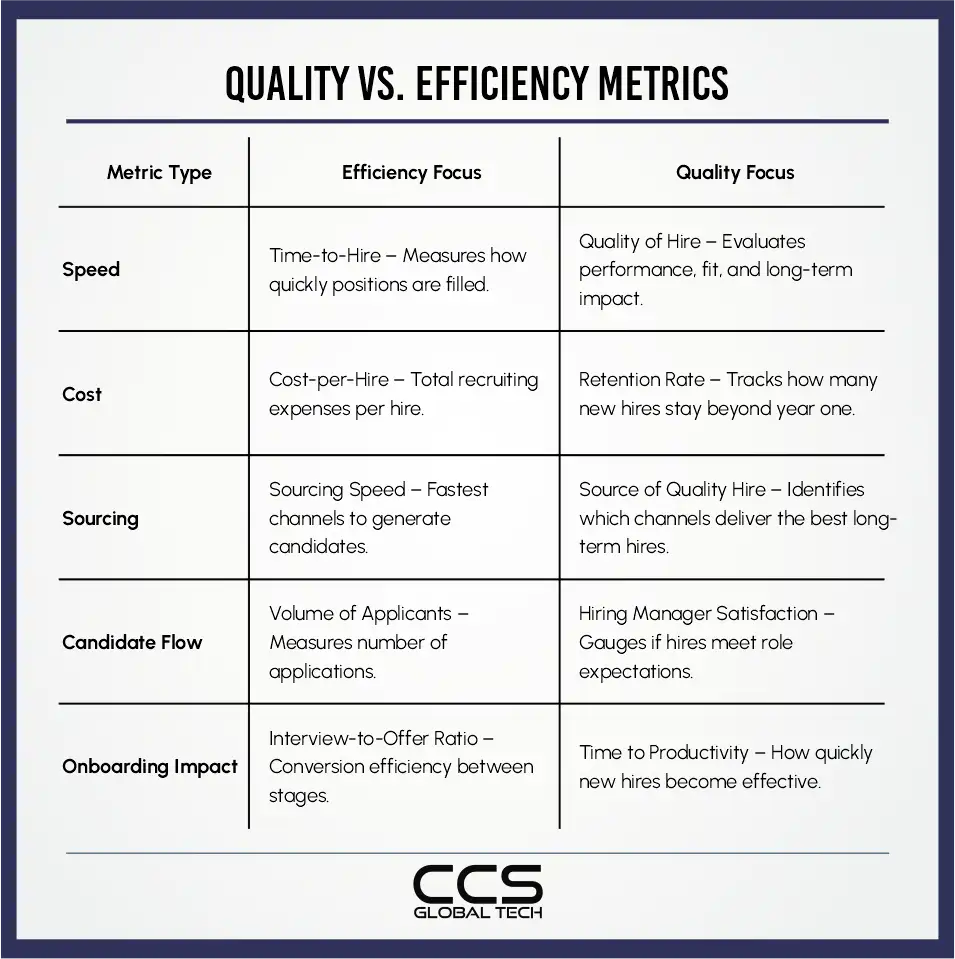

1. Efficiency Metrics: The Need for Speed and Optimization

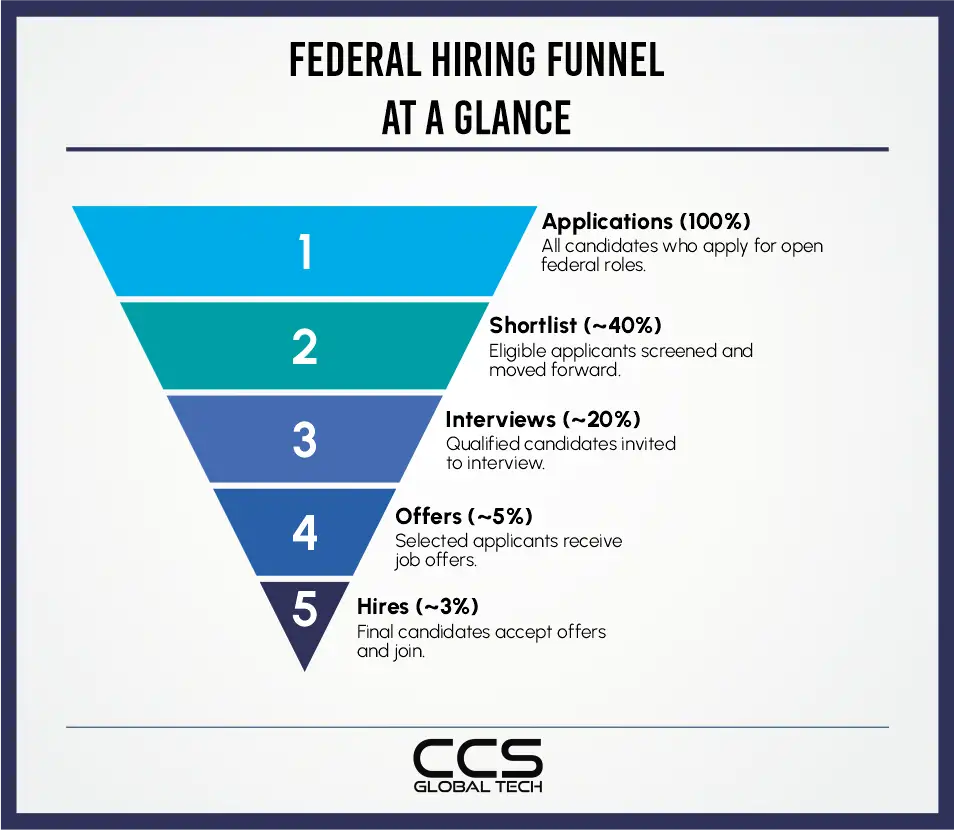

For the federal government, efficiency is a must. A mission can be derailed by hiring delays, and a slow procedure can, and has, turned away excellent applicants. These KPIs aid in workflow optimization and identification of potholes:

Time-to-Hire

This has been a classic: time-to-hire counts the days that pass between the approval of a job request and the acceptance of the offer by the applicant.

Why it matters: Lengthy time-to-hires can indicate several problems:

- Bureaucratic delays: Lack of coordination between departments.

- Inefficient screening: Struggle in sifting through large volumes of applicants.

- Slow-moving hiring managers: Managers dragging out in scheduling interviews.

The 2025 twist: The average time to employ should decrease with the use of meticulous screening technologies and applicant tracking systems (ATS). For non-essential tasks, the majority of top agencies are striving for a time-to-hire of less than ninety days, and for high-demand tech positions, even shorter.

Cost-per-Hire

This measure divides the entire cost of hiring a new employee by the number of hires made over a specific time frame. It takes a comprehensive approach, including everything from advertising and job board subscriptions to recruiter pay and job fair travel costs.

Why it matters: A high cost-per-hire could mean the team is spending excessively on redundant sourcing channels.

The 2025 twist: Hiring internally or through a referral is significantly less expensive than advertising externally. In order to determine which channels yield the highest return on investment, teams are now calculating cost-per-hire by source.

Sourcing Channel Effectiveness

Do you know where your best candidates are coming from? This tracks the number of quality hires attributed to each recruitment source through:

- USAJOBS

- Social media platforms

- Career fairs

- Employee referrals

- University partnerships

- Recruitment agencies

Why it matters: Resources can be shifted away from channels that perform lower than the ones that are.

The 2025 twist: The integration of machine learning into ATS platforms means this metric is becoming more sophisticated.

2. The Metrics of Quality and Impact

In 2025, federal recruitment isn’t about filling seats but about building a high-performing workforce that can tackle the complex challenges of the future.

Quality of Hire

Arguably, this is a crucial metric for any hiring team. A new hire’s value to the company is measured by their quality of hire. In contrast to efficiency measures, ask these:

- Performance Reviews: Do new hires meet or exceed their performance goals?

- Retention Rate: Do new hires stay with the agency for a significant period?

- Hiring Manager Satisfaction: How satisfied is the hiring manager with the hired employee’s performance and fit within the team?

- Time to Productivity: How long does it take for a new hire to become fully productive in their role?

Why it matters: A high-quality hire, one that makes a positive long-term impact on the agency, is the ultimate proof that a recruitment strategy is effective.

Source of Quality Hire

Understanding where the best hires come from helps in effectively identifying efficient channels for hire.

Why it matters: The most expensive recruiting source, like a specialized job board, could also be where the highest quality talent is found. In that case, the high cost is justified, which ultimately makes it a strategic decision.

The 2025 twist: The ATS can now connect candidate source information with performance data from HR systems, providing an end-to-end view of the entire recruitment process.

First-Year Retention Rate

Losing a new employee within their first year is costly. It’s not just the time and money spent on recruiting and training, but also the disruption to the team and the morale hit. First-year retention rate is measured by tracking the number of new hires who stay with the company for their first year, as compared to the number of new hires during a specific period.

Why it matters: A low retention rate can point to lots of issues. Is the job description accurate? Or is the new hire simply not a good fit?

The 2025 twist: The recruitment team’s job isn’t over at the offer letter; it’s done in a way that helps the new hire succeed. Presently, recruitment teams work closely with hiring managers and HR to ensure a smooth transition and a positive first year.

Through these quality metrics, there is now an efficient collaboration between a talent acquisition team and a strategic business partner.

But there’s one more piece of the puzzle.

3. The Candidate Experience and Strategic Impact

A federal agency’s reputation and capacity to draw in future talent can be significantly impacted by the treatment of applicants from the interview to the final call. The applicant experience is now a stand-alone KPI.

Candidate Satisfaction Score (CSAT)

This is a good measure of how satisfied candidates are with their experience, tracked through a short survey that is sent to every applicant, hired or otherwise. Questions could include:

- How would you rate the clarity of the job description?

- How satisfied were you with the communication from our recruitment team?

- Would you recommend working at our agency to a friend?

Why it matters: In addition to turning down an offer, top applicants who have a bad experience will also tell their network about it. In the era of reviews for just about anything on this planet, an agency’s reputation is always visible. Even for the applicants who were not hired, a high CSAT score indicates a reputable and sturdy corporate brand.

The 2025 twist: Modern ATS platforms can automatically trigger these surveys at key points in the recruitment process, providing immediate feedback. The data can be segmented to see where the experience is breaking down.

Offer Acceptance Rate

This is the percentage of candidates who accept a job offer from an agency. While it seems simple, this metric is a powerful indicator of existing competitiveness.

Why it matters: A low offer acceptance rate is a major red flag. It could mean the compensation isn’t competitive, the hiring process is too slow, or that candidates are getting a better offer somewhere else.

The 2025 twist: A competitive offer today encompasses more than just pay. It has to do with the agency’s culture, work-from-home options, and work-life balance. The acceptance rate of an offer in 2025 indicates how openly the entire benefits of working for the federal government were conveyed.

Employee Referral Rate

The employee referral rate is the percentage of new hires who were referred by an existing employee.

Why it matters: Referrals often lead to a lower cost-per-hire, a faster time-to-hire, and a higher quality of hire. People tend to refer those whom they believe will be a good fit, come with a recommendation, and will succeed in the organization.

The 2025 twist: Federal agencies foster their internal talent clusters and facilitate employee referrals in 2025. Crystal clear communication regarding available employment, targeted referral bonuses for in-demand roles, and automated referral programs drive this metric. A great employer and a happy, engaged workforce are indicated by a high referral rate.

Conclusion: Beyond the Numbers

In 2025, we find that federal hiring is a strategic rather than an administrative task. By focusing on these nine KPIs across Candidate Experience, Quality, and Efficiency, we can tell a story rather than merely recording data. Actively developing the workforce of the future means demonstrating to the leadership that the team is a mission-critical asset.

At CCS Global Tech, we think that the first step to improving your hiring procedure are these KPIs. The goal is to proactively acquire the talent to spur innovation and benefit the public, rather than merely employing people.

So, take a look at your current dashboards for a great future of federal service: Are you tracking the right things? Are you having the right conversations?

And if you need help building the systems and strategies to track these metrics, we’re here to help.

FAQs

Q1: How do federal recruitment KPIs differ from private sector metrics?

A: Federal recruitment KPIs must account for unique constraints like security clearance processing, stringent compliance requirements (e.g., OPM guidelines), and veteran hiring mandates (e.g., FEVS compliance). While private sector focuses heavily on speed-to-hire and cost, federal metrics balance efficiency with strict adherence to regulatory and mission-critical timelines.

Q2: What is the most overlooked KPI for improving federal recruitment quality of hire?

A: Post-Onboarding Performance Rating at 6/12 Months is critically overlooked. Tracking how a new hire’s performance reviews align with their pre-hire assessment scores directly measures recruitment efficacy and identifies gaps in vetting for specific roles, especially in technical or cleared positions.

Q3: Which KPIs best measure diversity and inclusion in federal hiring?

A: Beyond representation metrics, focus on:

- Diversity Sourcing Channel Effectiveness: Which platforms yield the highest volume of qualified, diverse candidates?

- Diversity Hire Retention Rate: Are diverse hires staying and progressing? This indicates inclusive onboarding and culture, not just hiring.

- Veteran and Disability Applicant Conversion Rates: Track progression from application to offer for these key groups.

Q4: With remote work, what KPIs track the effectiveness of virtual federal hiring?

A: Key metrics include:

- Virtual Interview-to-Offer Ratio: Measures the efficiency and effectiveness of the remote interviewing process.

- Candidate Experience Score for Virtual Process: Solicited via post-interview surveys focused on technology ease and communication clarity.

- Time to Security Clearance Initiation (Virtual Onboarding): Tracks if remote onboarding delays the critical clearance process.

Q5: How can we use KPIs to reduce time-to-fill for security-cleared roles?

A: Deconstruct the metric into two parts:

- Pre-Clearance Time: Days from req open to candidate accepting conditional offer.

- Clearance Processing Time: Days from initiation to clearance adjudication.

Tracking these separately pinpoints bottlenecks—is it sourcing or the clearance process itself? This allows for targeted process improvements.

Q6: What is a good benchmark for cost-per-hire in federal contracting?

A: A single benchmark is misleading due to role variance (e.g., CIO vs. Analyst). Instead, track Cost-per-Hire by Clearance Level (e.g., Public Trust, Secret, TS/SCI). TS/SCI roles will naturally have a higher cost due to longer timelines and more intensive vetting. Internal benchmarking against past performance for similar roles is more valuable than industry-wide figures.

Q7: Which predictive KPIs can forecast future federal recruitment challenges?

A: Leverage:

- Attrition Risk by Role/Team: Analyze turnover data to predict which mission-critical areas may need proactive recruitment.

- Pipeline Health Score: A composite metric of qualified candidates in the pipeline for high-turnover or hard-to-fill roles.

- Retirement Eligibility Forecast: A crucial federal-specific metric to anticipate a wave of vacancies and launch knowledge transfer programs early.

Q8: How should we measure the ROI of using AI-powered tools in our federal recruitment process?

A: Move beyond cost savings and track efficiency and quality gains specific to the federal landscape:

- Reduction in Manual Screening Hours per Requisition: Quantifies time saved on reviewing applications for OPM compliance and keywords.

- Improvement in Candidate-Clearance Match Rate: Measures if AI tools are better at predicting which candidates will likely obtain a clearance, reducing clearance denial fallout.

- Sourcing Channel Attribution for Hard-to-Fill Roles: Identifies which AI-enhanced platforms (e.g., cleared job boards, LinkedIn Recruiter) actually deliver hires for specific cleared roles like Cyber or Intel.

Q9: What are the essential KPIs for tracking the health of a pipeline for cleared talent, which has a longer time-to-fill?

A: For cleared pipelines, traditional metrics fail. Essential KPIs are:

- Pipeline Velocity: The average time a candidate spends in each stage (sourced → applied → cleared → hired). This identifies specific stage bottlenecks.

- Clearance Eligibility Rate: The percentage of candidates in the pipeline who already hold an active clearance or are likely eligible for a reciprocity waiver. This is a leading indicator of pipeline quality.

- Offer Acceptance Rate for Cleared Candidates: This niche metric is critical; it tracks if your compensation and offers are competitive within the secretive and highly competitive cleared talent market.

Q10: With the rise of skills-based hiring, what KPIs can track the effectiveness of assessing competencies over credentials?

A: To measure a shift to skills-based hiring, federal teams must track:

- Quality of Hire by Sourcing Channel (Skills-Based vs. Traditional): Compare the performance and retention of hires from skills-based assessments against those from traditional credential-focused sourcing.

- Assessment Pass Rate vs. Hire Performance: Correlate scores on role-specific skills assessments (e.g., a cyber simulation) with subsequent on-the-job performance reviews. This validates the assessment’s predictive power.

- Time to Productivity: A crucial KPI. If skills-based hires are becoming productive faster than those hired solely based on degrees or years of experience, it proves the new approach’s effectiveness.