The federal contracting landscape is experiencing its most dramatic transformation in decades.

The numbers tell the story: The federal government committed $755 billion on contracts in Fiscal Year 2024, a decrease of $22.5 billion from FY 2023 after adjusting for inflation. This isn’t just a budget adjustment. It represents a fundamental shift in how government procures services and evaluates contractor performance.

The implications are staggering: Organizations operating with outdated business models are losing competitive positioning while agencies demand significantly more value from every procurement dollar.

The federal contracting marketplace has always been cyclical, but 2025 presents unique challenges that demand fresh strategic thinking. The traditional approaches that built successful contractors over the past decade are becoming competitive disadvantages.

The New Reality: Smaller Pie, Higher Performance Standards

That $755 billion figure represents both opportunity and challenge. GSA manages about $100 billion in products and services through federal contracts, overseeing nearly 370 million square feet of real estate nationwide. This massive infrastructure demonstrates both the scale of opportunity and the complexity of modern procurement.

The shift: Agencies aren’t simply cutting budgets, they’re reallocating resources toward strategic priorities aligned with national security, technological advancement, and operational efficiency. This requires contractors to think beyond traditional service delivery toward comprehensive partnerships that demonstrate measurable value across multiple dimensions.

Market impact: Prime contractors are facing heightened competition because there are fewer opportunities available. The traditional approach of building large teams for long-term contracts is giving way to agile workforce models that can scale rapidly based on specific project requirements.

Technology Integration: From Optional to Essential

Federal agencies are demanding partners who can demonstrate how technology integration will improve mission outcomes, reduce costs, and enhance security. This isn’t about offering technology services, it’s about integrating sophisticated capabilities into every aspect of service delivery.

Example of this shift: GSA’s sustainability initiatives demonstrate the complexity of modern requirements. The commitment to transitioning 253,000 buildings to 100% renewable electricity by 2025, while requiring low-carbon construction materials in new structures, requires contractors to integrate environmental technology, data analytics, and traditional facilities management.

Organizations that can demonstrate technology integration across their service offerings are capturing disproportionate market share compared to those competing primarily on traditional capabilities.

Compliance Evolution: Strategic Differentiator vs. Administrative Burden

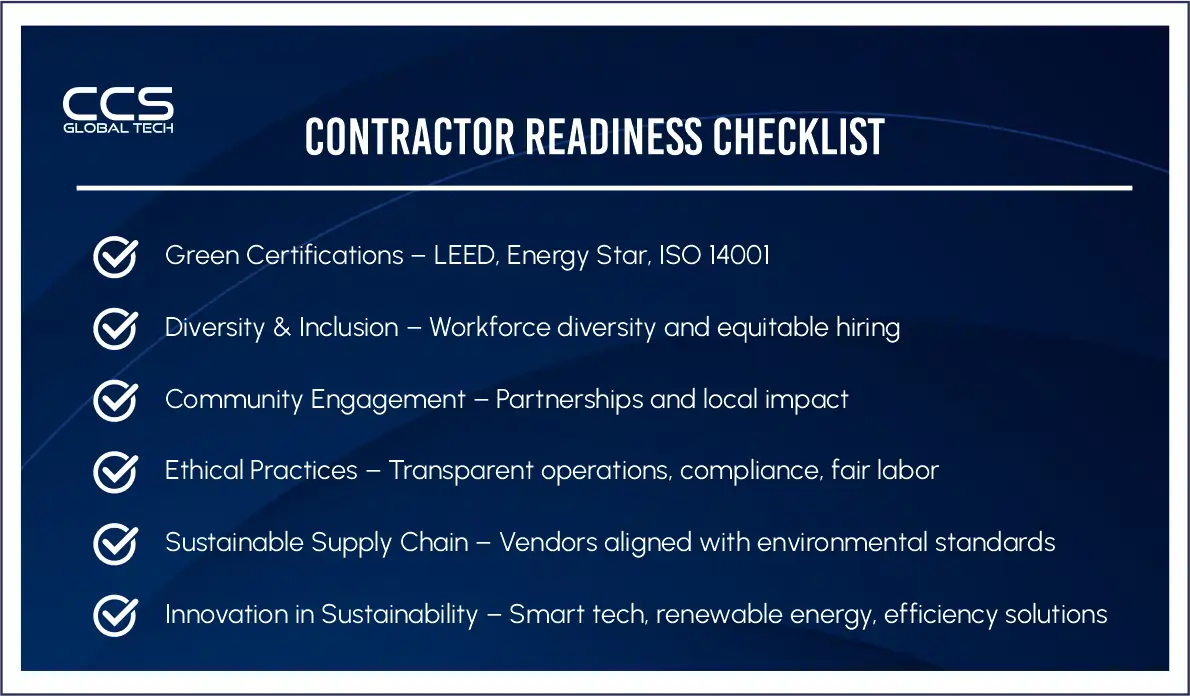

Federal contracting compliance has evolved beyond traditional procurement regulations to include sophisticated frameworks addressing cybersecurity, supply chain security, and Environmental, Social, and Governance (ESG) considerations.

The trend: Expanding agency missions, increased compliance requirements, and intensifying competition continue to drive themes impacting contractors’ operational costs, business development strategies, and competitive positioning throughout 2025.

Successful contractors are positioning their compliance capabilities as service enhancements rather than administrative requirements. This transforms compliance from cost center to competitive advantage.

Workforce Transformation: Dynamic Talent Models

The traditional model of maintaining large, stable workforces is giving way to dynamic talent ecosystems that can scale rapidly based on project requirements.

Security clearance complexity

Organizations that can efficiently manage cleared personnel while maintaining operational flexibility are gaining significant competitive advantages. The ability to rapidly deploy cleared talent when opportunities arise has become a critical capability.

Talent market reality

In an increasingly competitive environment, companies that create compelling employee value propositions combining meaningful work, professional development opportunities, and flexible arrangements are better positioned to attract and retain top performers.

Digital Transformation and Strategic Partnerships

Digital transformation represents fundamental shifts toward data-driven decision making and integrated platforms that provide real-time project performance visibility. Agencies are implementing advanced project management platforms that provide unprecedented visibility into contractor performance.

Partnership imperative

Strategic partnerships have become essential for addressing complex government challenges that require diverse expertise. Technology platforms are enabling new forms of collaboration impossible in previous decades through cloud-based systems, integrated communication platforms, and shared analytics tools.

Sustainability and Social Responsibility Integration

Environmental sustainability and social responsibility have emerged as integral evaluation criteria across agencies and contract types. GSA’s renewable energy initiative exemplifies this trend – the commitment to transitioning hundreds of thousands of buildings to renewable electricity represents a fundamental shift in government facilities management.

Beyond environmental considerations: Agencies increasingly seek contractors demonstrating positive community contributions, diverse workforce development, and ethical business practices aligned with public sector values.

Risk Management and Operational Resilience

Sophisticated risk management has become critical, reflecting the complex, interconnected nature of modern government operations. Agencies now evaluate contractors not just on service delivery capabilities under normal conditions, but on their capacity to maintain operations during disruptions and adapt to changing requirements.

Evolution of requirements: Cybersecurity risk management has evolved into a comprehensive discipline requiring continuous monitoring, regular assessment, and proactive threat response. Supply chain risk management has become increasingly sophisticated, requiring visibility into supply networks and alternative sourcing strategies.

Strategic Market Implications

These trends represent interconnected shifts requiring integrated responses and strategic thinking:

- Operational Excellence: Declining spending levels combined with increasing competition means success requires exceptional execution across all organizational performance dimensions.

- Technology Integration: Has become fundamental for remaining competitive, not an optional service enhancement.

- Compliance as Strategy: Has evolved from cost center to strategic capability that differentiates organizations.

- Workforce Agility: Requires new talent management approaches that accommodate changing skill requirements and work models.

- Sustainability Focus: Has become integral to business strategy rather than peripheral consideration.

- Partnership Strategy: Has become essential for addressing complex government challenges.

- Risk Management: Comprehensive frameworks ensure operations in increasingly uncertain environments.

Market Intelligence: Emerging Patterns

Current market observations indicate several additional trends:

- Accelerated Decision Cycles: Agencies are moving faster on critical procurements, favoring contractors who can respond quickly and demonstrate immediate capability.

- Performance-Based Contracting Growth: More agencies are shifting toward outcomes-based contracts rather than traditional time-and-materials arrangements.

- Geographic Distribution: Remote work capabilities are enabling agencies to access talent beyond traditional federal hubs, changing competitive dynamics nationwide.

Strategic Positioning Framework

Organizations that will thrive in this environment understand that success demands strategies beyond traditional service delivery:

- Technology Leadership: Demonstrate how technology integration improves mission outcomes and operational efficiency.

- Compliance Excellence: Transform regulatory requirements into competitive advantages that enhance service delivery.

- Workforce Innovation: Build flexible talent networks that can scale with opportunity while maintaining quality and security standards.

- Partnership Development: Create strategic alliances that expand capabilities without increasing fixed costs.

- Sustainability Integration: Develop environmental and social responsibility credentials that align with agency priorities.

- Risk Mitigation: Build comprehensive risk management capabilities that provide client confidence and operational resilience.

The Competitive Landscape

The federal contracting market in 2025 rewards organizations that understand government priorities, build strong relationships, and deliver performance paired with compliance excellence, innovative workforce management, sustainability leadership, and comprehensive risk mitigation.

- Success factors: Organizations must demonstrate value creation rather than just service delivery, integrate technology capabilities throughout their operations, and build partnerships that expand their ability to address complex government challenges.

- Market positioning: The government’s need for mission-critical partners who can advance modernization efforts while delivering measurable value offers significant growth potential for organizations willing to transform their approach.

Looking Forward

The federal contracting landscape presents both challenges and unprecedented opportunities. Success in this environment requires understanding that contractors aren’t just competing for task orders, they’re competing to become indispensable partners in advancing critical government missions.

The market dynamics favor organizations that can demonstrate technological sophistication, operational excellence, compliance leadership, workforce innovation, and strategic partnership capabilities. Traditional competitive advantages based primarily on past performance and competitive pricing are becoming insufficient for sustained success.

As a trusted partner and thought leader, CCS Global Tech is committed to helping organizations capitalize on these trends through strategic market insights, compliance expertise, and innovative solutions. Together, we can navigate the complexities of government contracting and drive sustained growth in 2025 and beyond.

FAQs

Q1- What are the biggest contracting trends federal agencies are prioritizing in 2025?

A: Agencies are prioritizing digital modernization, cybersecurity compliance, cloud migration, and workforce readiness as top contracting needs in 2025.

Q2- How is cybersecurity compliance influencing federal contract awards?

A: Compliance frameworks like CMMC 2.0 and FedRAMP are now baseline requirements, meaning vendors without strong cyber programs are being excluded from bids.

Q3- What role does AI and automation play in federal procurement this year?

A: AI and automation are helping agencies improve efficiency, reduce backlogs, and enhance data-driven decision-making, making them a major contracting driver in 2025.

Q4- How are budget priorities shaping government contracting opportunities?

A: Defense modernization, climate resilience, healthcare IT, and infrastructure projects are receiving significant funding, creating strong opportunities for contractors.

Q5- What challenges do small businesses face in competing for federal contracts in 2025?

A: Small businesses face compliance costs, supply chain risks, and competition from larger integrators, but set-aside programs remain a strong entry point.

Q6- Why is cloud adoption critical for agencies in 2025?

A: Agencies are moving workloads to secure, scalable cloud platforms to enable hybrid work, improve resilience, and align with federal IT modernization mandates.

Q7- How are diversity, equity, and inclusion (DEI) requirements affecting contractors?

A: Many agencies are incorporating DEI reporting into evaluations, rewarding vendors that demonstrate inclusive hiring practices and workforce accountability.

Q8- What procurement changes are helping agencies move faster in awarding contracts?

A: Agencies are using OTAs (Other Transaction Authorities), GSA schedules, and digital procurement platforms to accelerate acquisitions and reduce bottlenecks.

Q9- How is the push for sustainability influencing federal contracting?

A: Contractors offering green IT solutions, energy-efficient infrastructure, and ESG-aligned practices are gaining preference as agencies aim to meet sustainability goals.

Q10- What strategies can contractors use to stay competitive in 2025’s federal market?

A: Contractors should invest in compliance readiness, partnerships, talent pipelines, and emerging tech capabilities while aligning with agency mission priorities.