Sarah Martinez had spent eight years in HR at a mid-sized defense contractor when she received the call that would redefine her understanding of federal staffing. It was October 2025, only days into the new fiscal year, when her company secured a $47 million Department of Defense contract for cybersecurity infrastructure modernization. The excitement faded quickly. They now had just 90 days to staff 23 highly specialized roles, each requiring active clearances, niche certifications, and domain expertise already in short supply.

Sarah followed the playbook that had served her for years: postings, screenings, interviews, offers. But this time, everything broke down. Cleared cybersecurity professionals weren’t just scarce, they were essentially unavailable. The few qualified candidates were juggling multiple competing offers, many from firms paying premiums far beyond her budget. By week three, she had only two viable candidates. One wouldn’t clear for another six months.

Sarah’s struggle wasn’t unique. Across federal contracting, the rules had changed. Increased defense spending, rising cyber threats, rapid modernization mandates, and a severely constrained talent pipeline had created a perfect storm. Contractors were winning work they couldn’t staff, triggering delays, penalties, and contract risk.

Heading into 2026, the question confronting every contractor is no longer optional: Where will the talent come from? Understanding demand spikes, critical skill gaps, and how to secure cleared talent is now a survival imperative.

The Numbers Tell an Urgent Story

The FY 2026 national defense budget is $1.01 trillion, a 13% increase from FY 2025, fueling thousands of federal contracts. However, there are 500,000 to 700,000 cleared talent positions open nationwide, far exceeding the number of cleared professionals actively job-seeking. The global IT skills shortage will affect 90% of organizations by 2026, with cybersecurity vacancies critical in federal sectors. Filling cleared IT roles takes 41-60 days ideally, but security clearances can take 6-12 months or longer, making contract delivery challenging. A 2025 study shows that organizations using HR analytics (HRA) report faster hiring cycles, stronger alignment between candidates and roles, and improved offer-acceptance and new-hire retention.

Where Critical Shortages Hit Hardest in 2026?

Cybersecurity: Ground Zero

Federal contractors face a 265,000-worker cybersecurity gap on top of 1.25 million existing roles, only 83% of jobs filled. Veterans (13% of roles) bring clearances but can’t meet demand. White House initiatives promote skills-based hiring, but Q1/Q2 projects need talent now. Bureau of Labor Statistics (BLS) projection states that employment of information security analysts is expected to grow 29% from 2024 to 2034, much faster than average. Cleared cyber talent determines contract success.

AI & Advanced Tech: Fastest Growth

Federal AI modernization is accelerating, and contractors supporting these initiatives are feeling the shift. The White House AI Action Plan is pushing agencies to expand AI infrastructure, strengthen cloud and data environments, and adopt responsible-AI practices. This creates rising demand for talent that can design, deploy, and secure advanced AI systems, from machine learning engineering to AI governance, cloud architecture, and data-pipeline development.

As AI systems evolve quickly, so do the skills required to support them. Firms without strong internal upskilling programs, cleared-talent pipelines, and AI-ready workforce strategies are losing competitive ground to primes that have already invested in these capabilities.

Infrastructure & Engineering: Steady Demand

Construction needs 439K more workers amid infrastructure spending. GSA’s FY26 budget targets facility repairs, MATOCs favor small firms. Regional gaps persist, metro areas face high costs; rural sites struggle with recruitment. Flexible staffing models win.

Cleared Admin/Professional: Hidden Crisis

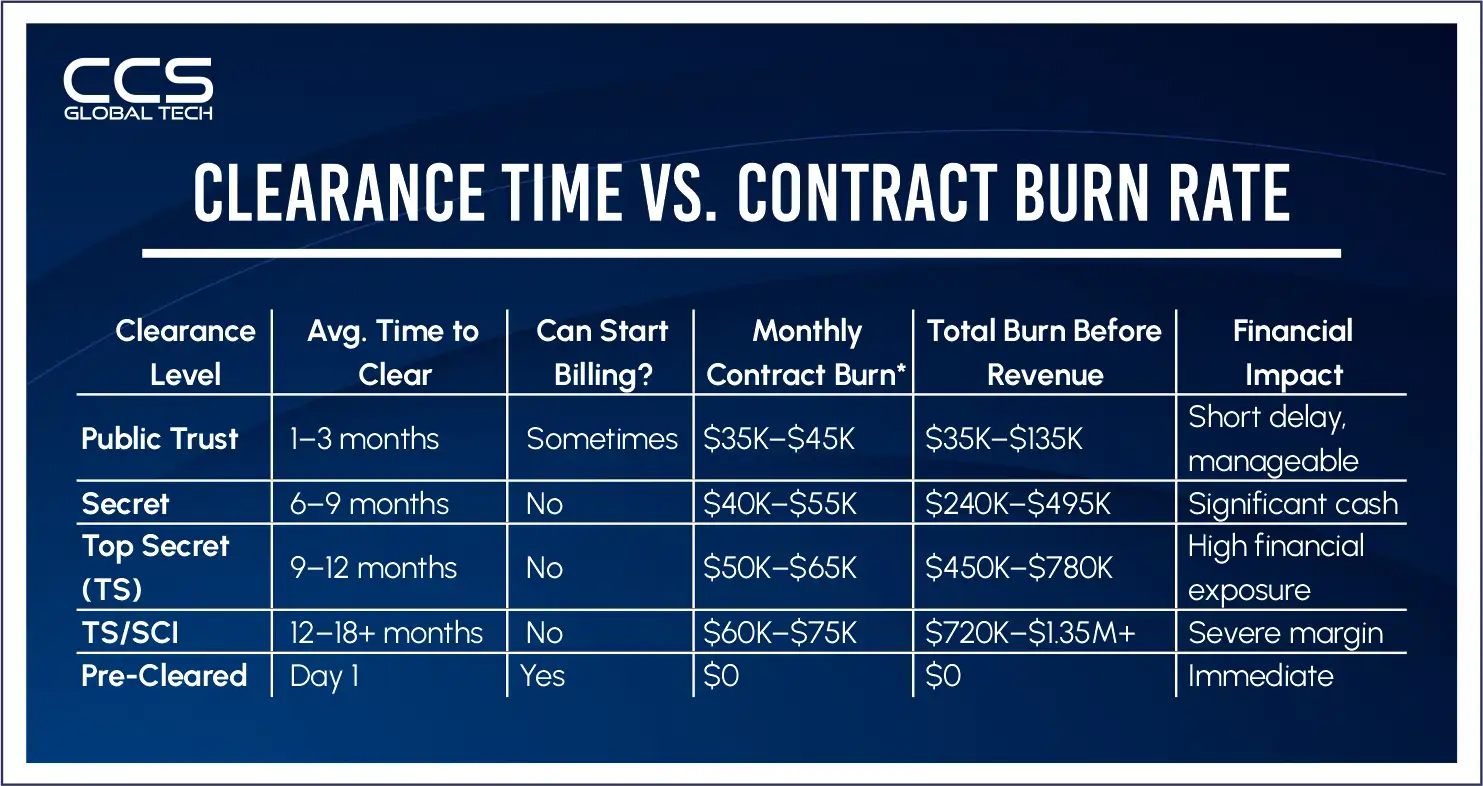

Cleared project managers, contract specialists, compliance officers, and financial analysts are essential but overlooked. Secret clearances take 6-9 months and Top Secret 12-18+ months, but contractors can’t bill uncleared staff or start the process without a contract. Interim clearances help some roles but not TS/SCI. Clearances aren’t transferable between agencies or levels, so pre-cleared talent means Day 1 billing while others face months of costs without revenue. Staffing agencies cut hiring time 40%, and cleared pros command salary premiums for their immediate value. Small contractors win with niche AI/compliance skills, veteran pipelines, and contract-to-hire models.

Regional Hotspots and Geographic Considerations

D.C. Metro (NoVA/MD): Prime hub—Dulles Corridor (Tysons/Reston/Ashburn) packed with Northrop, Booz Allen, primes/subcontractors. Fiercest cleared talent competition.

San Diego: Navy/Marine focus—GA, SAIC, Leidos. 10-20% lower salaries vs. D.C., better quality of life.

Colorado Springs: Space/intel—Peterson/Schriever SFBs. Satellite/cyber growth, lower COL.

Huntsville, AL: Missile/space—Redstone Arsenal/NASA. Engineering depth, cost-competitive labor.

Remote Reality: SCIF roles on-site only; admin/tech increasingly remote—national talent access advantage.

What Success Looks Like: Real Examples from the Field

Mid-Size DoD Contractor: Won cyber contract needing 15 cleared roles in 90 days. Traditional recruiting filled 3/15 by week 8- facing penalties. Switched to specialized staffing, veteran fairs, signing bonuses, fast offers. Filled 8/12 in 4 weeks using temps + work restructuring. Delivered on time.

Small IT Firm: No clearances, entered federal via GSA Schedule 70. Partnered as subcontractor to prime- gained experience/Past Performance. Used revenue to sponsor clearances, hired ex-CO, trained on FAR/DFARS. Now primes small contracts + teams larger ones.

Strategic Approaches for the 2026 Landscape

For federal contractors and the HR leaders who support them, success in the 2026 staffing landscape requires fundamentally rethinking traditional approaches. Several strategic imperatives emerge from analyzing the current environment and successful contractor practices. Some of them are-

- Build Cleared Pipelines: Engage talent communities/veteran networks year-round for instant access when awards hit.

- Partner with Specialists: Some firms that outsource recruiting or use RPO/agency partners report a ~30% reduction in time-to-hire versus previous processes.

- Prioritize Veterans: Pre-cleared, mission-ready talent qualifies for set-asides and preferences.

- Mix Staffing Models: Permanent core team + contract surge handles feast-or-famine cycles.

- Upskill Internally: Hire adjacent skills, sponsor clearances– cheaper/faster than external perfect fits.

Looking Beyond 2026: Positioning for Sustainable Success

Federal staffing shortages will persist beyond 2026 due to tech/defense growth, cyber crisis, and boomer retirements. Winners build lasting advantages.

- Continuous Learning: Skills evolve- train or fall behind.

- Skills-Based Hiring: Compete with agencies, drop degree barriers.

- Generational Shift: Capture retiring knowledge, empower juniors.

- Remote Expansion: Access lower-cost talent beyond traditional hubs.

CCS Global Tech’s 25+ years show federal staffing wins come from cleared networks, veteran ties, compliance, and speed, not budgets. We’ve delivered urgent DoD staffing, pipelines, and veteran placements across defense/intel/civilian. Need help with the execution?

FAQs

Q1 – Which federal sectors are expected to see the highest staffing demand in 2026?

A: Staffing demand is expected to peak in defense modernization, cybersecurity, cloud migration, data analytics, AI-enabled systems, and infrastructure-related programs tied to multi-year federal initiatives.

Q2 – Why is staffing demand peaking in 2026 instead of later years?

A: Many large federal programs awarded between 2023 and 2025 enter heavy execution phases in 2026, creating concentrated demand for cleared, technical, and program delivery talent.

Q3 – What roles will be hardest to fill in the 2026 federal contracting pipeline?

A: The most constrained roles include cleared engineers, cloud architects, cybersecurity analysts, DevOps professionals, program managers, and specialized IT support staff.

Q4 – How early should primes and subcontractors plan staffing for 2026 contracts?

A: Workforce planning should begin 12–18 months before expected contract execution to secure scarce talent, reduce onboarding delays, and avoid performance risk.

Q5 – How does delayed staffing impact federal contract performance?

A: Delayed staffing increases the risk of missed milestones, Cure Notices, negative CPARS ratings, and loss of follow-on work, especially during early delivery phases.

Q6 – Are cleared talent shortages expected to worsen in 2026?

A: Yes. Clearance requirements combined with rising technical complexity continue to limit available talent, making proactive sourcing and pipeline development critical.

Q7 – How are agencies and primes adapting to projected staffing shortages?

A: Many are shifting toward flexible staffing models, early pipeline engagement, contract-to-hire approaches, and pre-award talent identification to reduce execution risk.

Q8 – What contract types are driving the most staffing demand?

A: IDIQs, BPA task orders, large modernization programs, and multi-year IT services contracts tend to generate sustained staffing demand across multiple phases.

Q9 – How does the 2026 pipeline affect small businesses and subcontractors?

A: Smaller firms face increased competition for talent and must plan earlier, partner strategically, or leverage staffing pipelines to remain competitive and compliant.

Q10 – What is the biggest staffing risk organizations underestimate for 2026?

A: Many underestimate how quickly demand will spike once contracts move from award to execution, especially for roles requiring clearance, certifications, or niche expertise.